Fuliza Branch - Instant Loan App to Mpesa in Kenya

Lenders Inc.

Description of Fuliza Branch - Instant Loan App to Mpesa in Kenya

Fuliza Branch is an instant loan application designed to provide financial assistance to users in Kenya. This app facilitates quick access to loans via M-Pesa, a widely used mobile money transfer service in the region. By downloading the Fuliza Branch app on the Android platform, users can efficiently manage their financial needs, covering various expenses with ease.

The primary function of Fuliza Branch is to offer credit to individuals who may be facing financial constraints. Users can apply for loans ranging from Ksh 500 to Ksh 70,000, allowing flexibility in borrowing based on their needs. The application is particularly useful for covering urgent expenses, paying school fees, purchasing airtime, or addressing business-related financial obligations.

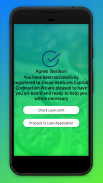

Upon downloading the app, users are required to register with their M-Pesa number, which serves as the primary identification for the loan application process. This straightforward registration process enables users to check their loan limits within the app. After determining their eligibility, users can apply for a loan that does not exceed their assigned limit.

Fuliza Branch provides a user-friendly interface that streamlines the application process. Once the loan is approved, funds are sent directly to the user’s M-Pesa account almost instantaneously. This quick disbursement is crucial for individuals who require immediate financial support. The application is designed to ensure that users have access to funds when they need them most, thus alleviating financial pressures.

Repayment terms for loans taken through Fuliza Branch are flexible and structured to accommodate users' financial situations. The app offers a shortest tenor of 91 days and a longest tenor of 180 days. For a 90-day loan, users will incur a one-time service fee ranging from 12.5% to 33% of the principal amount. For example, if a user borrows Ksh 1,000, the service fee could be Ksh 330, resulting in a total repayment amount of Ksh 1,330. This transparent fee structure allows borrowers to plan their repayments accordingly.

Users can repay their loans conveniently using M-Pesa through a designated pay bill number. Fuliza Branch supports both full and partial payments, allowing users to manage their financial commitments effectively. An easy repayment schedule is integrated into the app, helping users stay on track with payments and avoid accumulating debt. Timely repayments can also lead to an increase in the user's credit limit, enhancing their borrowing capacity for future needs.

Privacy and security are crucial aspects of the Fuliza Branch app. When users download and register for an account, their personal information is collected to verify their identity and assess creditworthiness. The app ensures that all sensitive data is encrypted, maintaining the confidentiality of user information. This emphasis on data protection fosters trust among users, as they can rely on the app to handle their details securely.

In addition to its financial features, Fuliza Branch encourages responsible borrowing. Users are advised to only seek loans for emergencies and to avoid using the funds for leisure purposes. The app promotes the principle of pre-planning for loans, urging users to consider their repayment capabilities before taking on debt. By emphasizing responsible borrowing practices, Fuliza Branch aims to help users maintain healthy financial habits.

The app also includes a referral program, rewarding users for bringing new customers to the platform. This initiative not only incentivizes sharing the app with friends and family but also helps to expand the community of users who benefit from its services.

Fuliza Branch stands out for its entirely digital process, eliminating the need for physical paperwork or in-person visits to financial institutions. This convenience is particularly appealing in today's fast-paced world, where users prefer quick and efficient solutions to their financial needs. The app's design caters to the needs of modern borrowers, offering a seamless experience from application to repayment.

With its focus on providing instant loans and supporting users through financial challenges, Fuliza Branch positions itself as a reliable solution for those in Kenya seeking quick access to funds. The combination of flexible loan amounts, transparent fees, a user-friendly interface, and a commitment to privacy makes it a compelling choice for individuals looking to manage their financial needs effectively.

For those interested in exploring the features of Fuliza Branch, downloading the app can be the first step toward achieving financial relief and stability. Through its innovative approach to lending, the app aims to empower users in their financial journeys.